Benefit from a Research and Innovation Tax Credit (CIR et CII)

Are you looking to embark on an innovative project? You may be eligible for the Research Tax Credit (CIR) or the Innovation Tax Credit (CII).

Com par l’image, the owner and creator of IMASCIENCE, is recognized by the Ministry of Higher Education, Research and Innovation as an organization conducting research, development, and innovation work on behalf of its clients for the periods 2020-2021-2022.

What does it mean for you? Any private company that seeks our expertise can benefit from a tax deduction on expenses incurred in research or innovation.

What is the CIR? Research & Development: a 30% tax deduction.

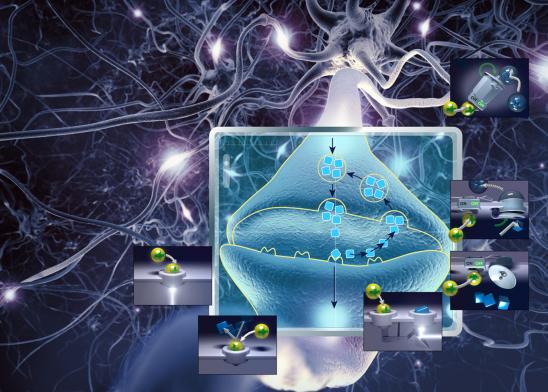

Our Research & Development activities allow us to offer you original digital solutions that align with your innovation projects.

By using virtual reality or medical 3D animation, you can enhance and explain your research in a clear, precise, and tailored manner to your various stakeholders.

Our team of scientific illustrators, with an in-depth understanding of your industry, maintains a close relationship with you to address your challenges and support you in your CIR process.

Innovation Tax Credit: Funding for your scientific visual communication projects

An extension of the Research Tax Credit, the Innovation Tax Credit (CII) is a tax measure aimed at small and medium-sized enterprises.

The Innovation Tax Credit: What expenses are eligible?

You can claim a tax deduction of:

- 20% for expenses related to the design of prototypes and pilot installations of new products (40% in overseas departments and Corsica for expenses incurred for fiscal years ending on or after December 31, 2019).

- Capped at 400,000 euros per year per company

How to benefit from the Innovation Tax Credit?

The declaration is made using the same form Cerfa No. 2069-A-SD and following the same procedures as the Research Tax Credit (CIR). It must be submitted to your tax office at the same time as the final tax return if you are subject to corporate tax. Or at the same time as the annual income tax return for companies subject to personal income tax. For additional information, you can contact the Ministry of Higher Education and Research.

Does your scientific project qualify for the Research Tax Credit or the Innovation Tax Credit?

Although both aim to advance science and research, the Research Tax Credit (CIR) and the Innovation Tax Credit (CII) are intended for different types of innovative projects in companies.

If your project is aimed at advancing the state of the art, meaning improving scientific and technical knowledge from the early stages of your work, it is eligible for the Research Tax Credit (CIR). This falls under the concept of research and development.

If you are in the phase of designing or creating a prototype or pilot installation for a new product, your project falls under the Innovation Tax Credit (CII). The objective here is technical or technological innovation.